CPA Client Bulletins

Charitable donations usually can be deducted on Schedule A of Form 1040, along with other itemized deductions. You should have the required support materials, in case your charitable deduction is questioned.

Charitable donations usually can be deducted on Schedule A of Form 1040, along with other itemized deductions. You should have the required support materials, in case your charitable deduction is questioned.

What’s Inside

- Deducting Charitable Gifts

- Tax-Efficient IRA Withdrawals

- Cybersecurity for Business Owners

- Tax Calendar

READ ISSUE

CPA Client Bulletins

Among the itemized deductions on Schedule A of Form 1040, you’ll find “Interest You Paid.” As you get your records together for tax preparation, you should realize that not all interest can be deducted on your return. Interest you paid last year on credit card debt generally isn’t deductible, for example.

Among the itemized deductions on Schedule A of Form 1040, you’ll find “Interest You Paid.” As you get your records together for tax preparation, you should realize that not all interest can be deducted on your return. Interest you paid last year on credit card debt generally isn’t deductible, for example.

What’s Inside

- Deducting Interest Paid

- The IRS May Put You on Hold

- Portability in Estate Planning

- Tax Calendar

READ ISSUE

CPA Client Bulletins

When you file your 2015 federal income tax this year, you can take a standard deduction. For 2015, that’s $6,300 for single taxpayers and for married individuals filing separately; $12,600 for couples filing jointly and for certain widow(er)s; and $9,250 for those filing as heads of household. The beauty of taking the standard deduction is that it’s simple: There’s no need to gather information and scant risk of triggering an audit.

What’s Inside

- Deducting Taxes Paid

- Deducting IRA Contributions

- Going Outside to Sell Your Company

- Tax Calendar

READ ISSUE

WRDR News

The Accounting firm of Wermer, Rogers, Doran and RUlOn, LLC is pleased to announce that Mary ELancaster, CPA has been named a partner in the firm. The promotion to partner will take place January 1st 2014.

The Accounting firm of Wermer, Rogers, Doran and RUlOn, LLC is pleased to announce that Mary ELancaster, CPA has been named a partner in the firm. The promotion to partner will take place January 1st 2014.

Mary E. Lancaster has been practicing public accounting since 1988 and has been auditing governmental entities, not for profit entities, health care organizations, employee benefit plans, and commercial enterprises. She also has experience in tax planning and preparation for individuals, trust and estates, not for profit, and corporate clients.

Mary Lancaster is a graduate of Lewis University with a Bachelor of Arts degree. Mary is a member of the American Institute of Certified Public Accountants and Illinois CPA Society. She is Past Chair of: the Administration Commission of the Cathedral of St. Raymond, the Cathedral of st. Raymond school board, and Will Grundy Center for Independent Living. Mary has also served on various boards and is a member of many community organizations such as Zonta and the Joliet Chamber Council for Working Women.

Mary Lancaster is also one of the three Women of WJOL radio heard every Friday morning at 9:00am on 1340 am radio. In her capacity with WJOL radio, Lancaster has emceed, interviewed and participated in many local live auctions for such organizations as BBBS, Rialto, Hugs, Guardian Angel, Senior Services and Children’s Advocacy Center.

Mary has been married to Tom for 30 years. She is the mother of two boys, Tommy (wife Amber) and Reed, and grandmother of Tommy IV.

WRDR News

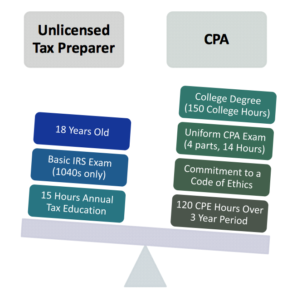

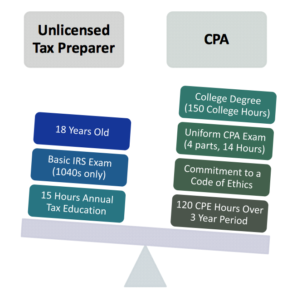

A CPA is substantiated by educational and professional requirements. We must adhere to strict state licensing guidelines that distinguish us from other tax preparers. Part of the value of a CPA is the ability to turn the overwhelming into the digestible. Choosing Wermer, Rogers, Doran & Ruzon, LLC is an invaluable decision and will prove very beneficial to you as your trusted advisor for your tax service needs and beyond.

A CPA is substantiated by educational and professional requirements. We must adhere to strict state licensing guidelines that distinguish us from other tax preparers. Part of the value of a CPA is the ability to turn the overwhelming into the digestible. Choosing Wermer, Rogers, Doran & Ruzon, LLC is an invaluable decision and will prove very beneficial to you as your trusted advisor for your tax service needs and beyond.

Charitable donations usually can be deducted on Schedule A of Form 1040, along with other itemized deductions. You should have the required support materials, in case your charitable deduction is questioned.

Charitable donations usually can be deducted on Schedule A of Form 1040, along with other itemized deductions. You should have the required support materials, in case your charitable deduction is questioned.

Among the itemized deductions on Schedule A of Form 1040, you’ll find “Interest You Paid.” As you get your records together for tax preparation, you should realize that not all interest can be deducted on your return. Interest you paid last year on credit card debt generally isn’t deductible, for example.

Among the itemized deductions on Schedule A of Form 1040, you’ll find “Interest You Paid.” As you get your records together for tax preparation, you should realize that not all interest can be deducted on your return. Interest you paid last year on credit card debt generally isn’t deductible, for example.

The Accounting firm of Wermer, Rogers, Doran and RUlOn, LLC is pleased to announce that Mary ELancaster, CPA has been named a partner in the firm. The promotion to partner will take place January 1st 2014.

The Accounting firm of Wermer, Rogers, Doran and RUlOn, LLC is pleased to announce that Mary ELancaster, CPA has been named a partner in the firm. The promotion to partner will take place January 1st 2014. A CPA is substantiated by educational and professional requirements. We must adhere to strict state licensing guidelines that distinguish us from other tax preparers. Part of the value of a CPA is the ability to turn the overwhelming into the digestible. Choosing Wermer, Rogers, Doran & Ruzon, LLC is an invaluable decision and will prove very beneficial to you as your trusted advisor for your tax service needs and beyond.

A CPA is substantiated by educational and professional requirements. We must adhere to strict state licensing guidelines that distinguish us from other tax preparers. Part of the value of a CPA is the ability to turn the overwhelming into the digestible. Choosing Wermer, Rogers, Doran & Ruzon, LLC is an invaluable decision and will prove very beneficial to you as your trusted advisor for your tax service needs and beyond.